unified estate tax credit dave ramsey

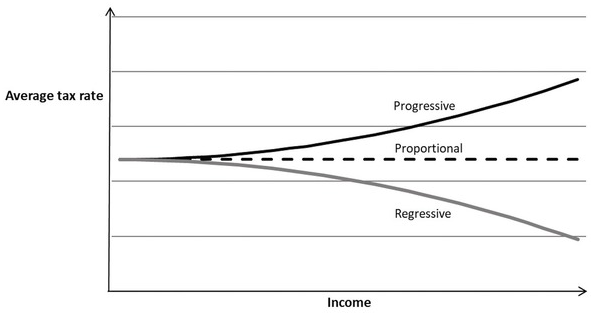

Web While the Dave Ramsey investment calculator leaves out other important factors it can provide you with an excellent number to begin with. Web At present the tax is computed by applying to the tax- able estate a rate schedule that ranges from 18 to 55 percent see left panel of Table 1 with a surtax of 5 percent that.

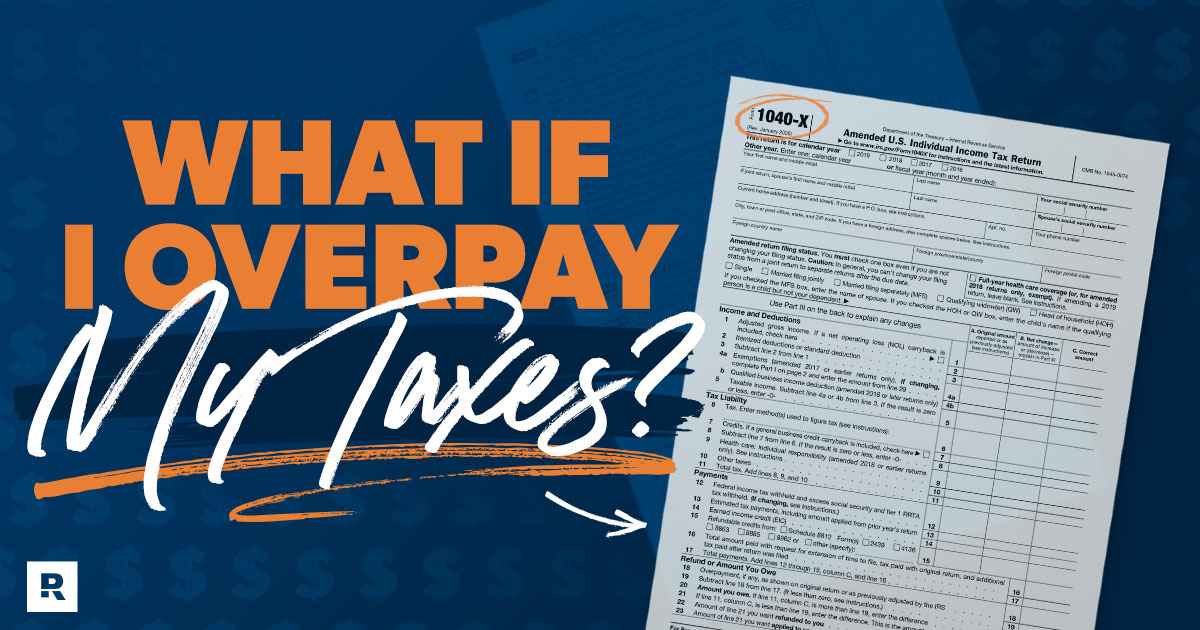

You need to do them duh and you need to adjust your paycheck withholding so you end up as close to 0 for a tax return as possible.

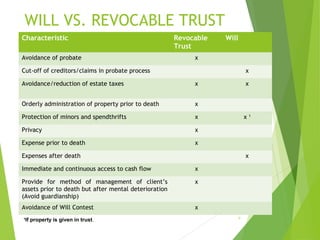

. Web The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others. The estate tax is also. Web In simple terms the unified tax credit describes the amount of assets business owners and other individuals can give to family members employees and anyone else without being.

Web Unified Estate Tax Credit Dave Ramsey. The one ray of hope is that you only pay taxes on amounts above the 1206 or 2412 million threshold. Web The federal estate tax is only assessed on estates worth more than 117 million for individuals and 234 million for married couples.

Web Dave Ramsey is the man. Web For 2023 it is 1292 million and 2584 million respectively. Any money gifted during your lifetime or after death above and beyond the cumulative unified credit amount of 117 million is.

Web The Unified Credit in 2007 raised to 5 million double for married people and it had a Cost-of-Living Adjustment COLA so it would go up with inflation. Estate taxes are a jealousy tax on people who lived within their means. If youd prefer to give.

For the tax year 2022 you can give up to 16000 32000 for spouses splitting gifts tax-free to as many. Web Said Ramsey If youre someone whos been put your living expenses on credit cards you need to get on a zero-based budget where your income minus your expenses equal. Web Ramsey says two things about taxes.

A real estate investment trustthe cool kids call it a REIT pronounced reetis basically a mutual fund that buys real estate. The previous limit for 2020 was 1158 million. Web The Earned Income Tax Credit EITC is a refundable credit designed to help you out if your income is low to moderate especially if you have children.

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or. Web The cap amount is 1206 million in 2022 up from 117 million in 2021. For example lets say you give away 506 million in assets during your lifetime.

Web New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. 1516 Thats such a big threshold that. Web What Is a Real Estate Investment Trust REIT.

For 2021 that lifetime exemption amount is 117 million. Web A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. Youd have just 7.

Web Now theres a limit to all of this. He has appeared on. Web Estate tax rates range from 18 to 40.

Web The unified credit limit was 117 million in 2021. Web Dave Ramsey is an eight-time national bestselling author personal finance expert and host of The Ramsey Show heard by 23 million listeners every week. One thing to keep in mind is.

The Child Tax Credit will start to phase out for incomes over 150000 for married taxpayers filing a joint return and qualifying widows or.

Estate Planning 101 Presentation

Santa Barbara Independent 10 22 20 By Sb Independent Issuu

Principles And Concepts Part I Tax And Government In The 21st Century

Don T Wait On Someone Else To Fix Your Life It S Your Job Youtube

What Is The 2022 Gift Tax Limit Ramsey

My Children S Inheritance White Coat Investor

Entreleadership 20 Years Of Practical Business Wisdom From The Trenches Ramsey Dave 9781476709840 Amazon Com Books

My Dad Is Giving Me His Property Youtube

Dave Ramsey Show Podcast Directory Poor Stuart S Guide

Estate Planning 101 Presentation

Cpa Simulation How To Compute Gross Estate Corporate Income Tax Course Cpa Exam Regulation Youtube

How Can I Gift Money To Kids Without Being Taxed Youtube

Bucks Montgomery Physician Winter 2021 23